Strengthening Health Together

7. October 2025

27. August 2025

What drives communication? Here are the answers. After all, Rheinmetall is currently under public observation like almost no other company. A cross section of the dozens of media enquiries that the DAX-listed group receives every day from all over the world.

To what extent is the Panther battle tank a competitor to the Franco-German MGCS programme?

The Panther KF51 main battle tank is to be seen as a complementary main battle tank concept. The European project is scheduled for completion in 2040. Rheinmetall’s business consideration was therefore that a new tank was needed as a bridge solution for the long interim period. Together with the Hungarian government, the corporation is developing the Panther to series production readiness. It is intended to form the basis for the new Italian main battle tank. In general, battle tanks are experiencing a renaissance, as European countries are once again focusing more on homeland defence and defending the alliance, yet their tanks are outdated. As a next-generation battle tank, the Panther has significantly increased combat power thanks to its 130 mm gun. It is also fully digitalised, has a drone defence system, and deploys its own drones.

What would a sudden end to the war in Ukraine mean for Rheinmetall?

Even if peace is achieved in Ukraine, Inspector General Carsten Breuer, the highest-ranking officer in the Bundeswehr, believes that Russia will continue to massively increase its number of troops. Accordingly, the Russian armed forces want to have “reconstituted themselves by 2029 in such a way that an attack on NATO territory would be possible”. At their summit in June 2025, NATO member states decided that in the future they will invest five percent of their GDP in security and defence. The five percent mark should be reached by 2035 at the latest. Previously, the target was two percent. In his first government statement in the German Bundestag, Chancellor Friedrich Merz announced that the federal government intends to “provide in future all the financial resources the Bundeswehr requires to become the strongest conventional army in Europe”. In this respect, Rheinmetall expects a decade of rearmament in Europe – even if the war in Ukraine should be ended through diplomacy.

How will Donald Trump’s tariff policy affect Rheinmetall?

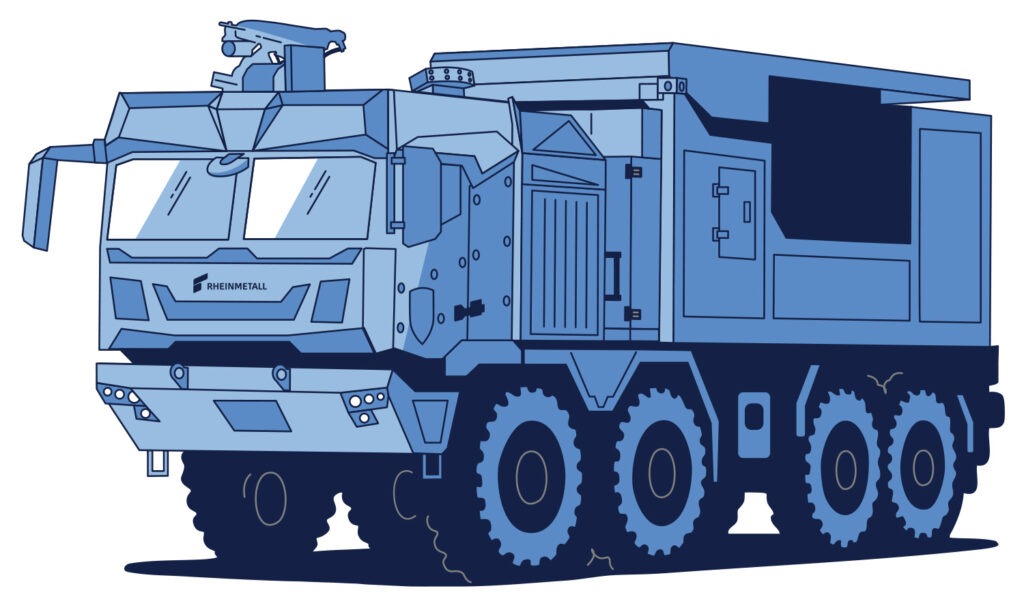

Rheinmetall has continuously strengthened its industrial base in the United States in previous years, most recently through the acquisition of the long-established manufacturer LOC Performance. This makes Rheinmetall part of the US defence industry foundation. American Rheinmetall now manufactures defence industry products at eleven sites in the country as a “fully American” supplier. The products offered by Rheinmetall in the USA are therefore not affected by any US import custom duties. In addition, the company is well positioned in two major US programmes: the XM30 combat vehicle and the Common Tactical Truck (CTT).

In light of the crisis in the automotive industry, what does the future hold for Rheinmetall’s civil business?

Business in the Power Systems division has been slightly declining recently. The industry trend currently offers automotive suppliers in Germany little opportunity for growth. From a strategic perspective, automotive supply is therefore no longer part of Rheinmetall’s core business. The corporation wants to offer its employees secure prospects. Rheinmetall is therefore converting two plants from the civil business and making them available for the security and defence industry. The Berlin plant (formerly Pierburg) has been assigned to Rheinmetall’s military division since 1 July 2025 to manufacture metal components for projectiles. The Neuss plant in the Lower Rhine region, parts of which will become a site of the Weapon and Ammunition division on 1 October 2025, will in future manufacture protection systems (armouring). The executive board of Rheinmetall AG is currently seeking solutions for the remaining activities of the civilian Power Systems division. Purchase enquiries from potential interested parties are being examined thoroughly.

What is Rheinmetall doing to supply Ukraine with artillery ammunition?

Combat vehicles are built in small quantities and do not roll off an assembly line as they do in the civilian automotive industry. It can take two years from an order placement to delivery. The production is complex because different customers have individual and special requirements for “their” armoured vehicle. Tank engines are customised products that no manufacturer has “on the shelf”. Cannon barrels and armour steel also have long order periods. Many suppliers are involved. Their capacities therefore also play a role – as does the availability of material and other factors.

What is Rheinmetall doing to supply Ukraine with artillery ammunition?

Since the beginning of the Ukrainian war, Rheinmetall has increased its production capacity for 155mm artillery ammunition tenfold – from 70,000 a year to 700,000 today. It will even reach a capacity of around 1.1 million rounds shortly. This makes Rheinmetall the world’s largest manufacturer in this field. The Russian threat is prompting many NATO and EU countries to replenish their ammunition stocks. Nevertheless, Rheinmetall has prioritised supplying Ukraine since the start of the war. The armaments group is one of the country’s most important technology partners for large-calibre ammunition. Rheinmetall recently received a framework contract from the Bundeswehr for supplying artillery ammunition worth €8.5 billion – including Ukraine.

How is the Rheinmetall curb charger protected against rain and snow?

As with all Rheinmetall products, safety is the top priority for the market innovation of the curb charger. The electronic components are “encapsulated” in accordance with IP68 certification, meaning they are protected against water and dust. The charging socket is fitted with seals and water drains – important in heavy rain. If water accumulates, the charging process is interrupted by a water level sensor before the ground fault circuit interrupter (GFCI) triggers. At low temperatures around freezing point, the curb charger is heated – snow and ice don’t stand a chance. A built-in heating system ensures that the charger can be operated even at sub-zero temperatures. Pilot projects are currently underway in several cities to test the curb chargers in daily practice.

Which professions are currently most in demand at Rheinmetall, and how are the numbers of applicants developing?

Rheinmetall is growing; the order books are full. To cope with the growing demand, Rheinmetall is urgently looking for skilled workers – in particular, industrial mechanics, machine and plant operators, mechatronics technicians, electronics technicians, cutting machine operators, welding technicians, aircraft mechanics, metalworkers, coachbuilders, and painters. In terms of white-collar profiles, the Group has a particularly high demand for engineers – especially in the fields of mechanical and electrical engineering. IT experts, software developers, project managers, purchasers, logisticians, and controllers are also in demand. The technology and defence group is happy about the growing interest. Rheinmetall’s recruiting centre received around 82,000 applications in the first half of this year. Between 2019 (around 57,000) and 2023, the number of applications received by Rheinmetall in Germany almost doubled to 108,000. In 2023, there were more than 180,000 proactive applications and applications for advertised positions worldwide.

Click here to receive push notifications. By giving your consent, you will receive constantly information about new articles on the Dimensions website. This notification service can be canceled at any time in the browser settings or settings of your mobile device. Your consent also expressly extends to the transfer of data to third countries. Further information can be found in our data protection information under section 5.